Most of us are taught that saving more is always better, but can you actually be too good at it? Over-saving for retirement can lead to strained relationships, missed experiences, and even neglected health.

Ask yourself: Are you sacrificing today’s joy for future security you’ve already achieved? In this article, we explore five key signs that you may be saving too much and how to find balance between enjoying life now and securing your future.

1. Strained Relationships

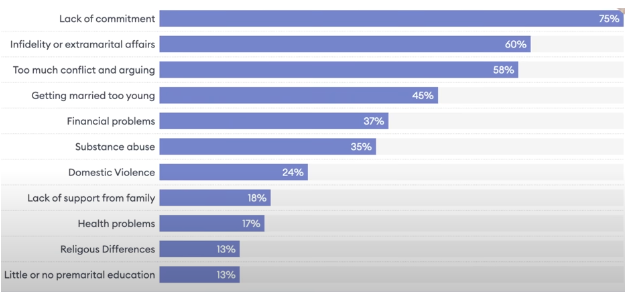

Are you skipping life experiences or delaying purchases due to an obsession with saving? Per Forbes Advisor’s 2024 study, Financial tension is one of the top contributors to relationship stress and divorce. Early frugality, which might have been necessary, can become overbearing later in life.

https://www.forbes.com/advisor/legal/divorce/divorce-statistics

Ask yourself: Are my savings habits causing unnecessary friction with my spouse or loved ones? Is this constant focus on frugality driving a wedge between us?

2. Missing Out on Life

Are you staying home to avoid spending, skipping vacations, or declining outings? Neuroscientist Matt Johnson found that novelty—experiencing new things—slows down our perception of time and makes life feel richer. The lack of new experiences can cause life to feel monotonous, even though you’ve worked hard for the financial freedom to enjoy it.

Ask yourself: Am I living a fulfilling life right now? Is my focus on saving causing me to miss out on the joy that new experiences bring?

3. Exceeding Financial Goals

If you’ve hit or exceeded your retirement savings targets, why keep pushing so hard? For example, if you’re ahead of the recommended benchmarks (such as Fidelity’s guideline of having 6x your salary saved by age 50), you might be saving more than necessary.

Ask yourself: Have I reached my financial independence number? If so, what’s holding me back from enjoying the freedom I’ve earned?

4. Over-Optimizing Small Savings

Are you spending valuable time on low-impact tasks like clipping coupons or driving across town to save a few cents on gas? While being frugal can feel rewarding, over-optimizing small savings can waste your most valuable resource: time. Calculate your “buyback rate”—if an activity saves you less than the value of your time, it might not be worth it.

Ask yourself: Is my time better spent on meaningful experiences or over-optimizing minor savings?

5. Sacrificing Health and Safety

Are you putting off important health care visits or security-related purchases to save money? If you’re avoiding doctor visits, under-insuring, or skipping car maintenance to save money, you might be sacrificing more than your bank account. Good physical and mental health is essential for enjoying the retirement you’re saving for, so don’t skimp on what keeps you safe and well.

Ask yourself: Am I prioritizing my long-term health and well-being over short-term financial savings?

Find the Right Balance

While saving for retirement is critical, so is knowing when to shift from accumulation to enjoyment. Over-saving can lead to missed opportunities and strained relationships. Finding balance ensures that you enjoy life today without jeopardizing your future.

Ready to assess your financial balance?

Schedule a financial strategy session today, and we’ll help you evaluate whether you’re saving enough—or perhaps too much—so you can live a fulfilling life now and in retirement.